Final Year MBA Project Objective:

Despite market expansion the profit generation is still a question mark, so companies have to search for areas of next generation like value added services, software enhancement and development other than just BPO services to survive in the market.

- · In the present day economies are globalized and the stabilities of them is really at stake, the only rescue for the software companies is to improve their responsiveness to the changing scenarios.· Companies have to develop their services to the bench mark level or global standards so that they can have acceptance all over the world.

- The troubles of many exporters are not a result of the volatility of the rupee but the unfavorably high-cost structure. Exporters are viable only when foreign exchange earnings get converted into more and more rupees. To improve rupee viability and preserve profits, exporters need to be efficient and productive and bring down aggregate rupee cost.

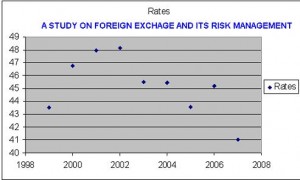

- Poor viability will not be resolved by hedging. Considering an inefficient exporter, it requires a break even exchange rate of Rs.45 dollar to show profit. It will dazzle at a rate above Rs.45. It will fizzle at any exchange rate below Rs.45.

- In case of forward contract. The forward contract locks in the exporter conversion of dollar revenues to rupee revenues at Rs.41, the market forward price per dollar. The market will surely not buy the exporters dollars at Rs.41 will be wholly ineffective exporters will be in serious trouble despite the perfect hedge.

- The problem of viability will be solved only when the exporters break even moves down to Rs.41 per dollar. By contrast, an inefficient exporter that is viable at Rs.41 peer dollar can take advantage of the hedge.

- The implicit dollar method will significantly preserve the dollar profitability exporters. The employees and managers of exporting firms will be paid implicitly in dollars. The cost to the company will be in dollars. But the payout will be in rupees and at the prevailing exchange rates. If the dollar weakens, the dollar costs of employees and managers will be paid out in rupees at say, RS.39, if the dollar strengthens the cost of employees and managers will be paid out in rupees at say, Rs.43.

- To overcome these problems exporters should make good governance by making available superior human, social and business infrastructure even if the tax rates are high. Good governance lower the costs of operations and lowers the aggregate costs of doing business.

Download MBA Project Study on Foreign Exchange and Its Risk Management.

I’m not able to download this project report. Could you send it to my mail ?