Financial Planning and Analysis Project is a management software developed in asp.net. Main objective of this application is to help organizations to manage expenditure, assets, financial goals and insurance details. We can generate reports for analysis on various topics.

Financial Planning and Analysis Modules:

- Behaviours Module

a. Question Category Master

It is used to create the Question Categories for the questions and update the existing Question Categories and can define the sequence of their trigger to an investor. The categories can be Investment Stability, Risk Appetite etc. The field is captured in this form pertaining to Question Category details information are:

Question category: This field contains the details of the Categories for the questions.

b. Question Master

It is used to create the Questions and update the existing Questions as per the Question Categories.Question Master will have various questions defined/Added under each Question Category. Every Question will have 5 Optional answers with predefined scores for every answer. User can also define the sequence of their trigger to an investor within the question category.The field is captured in this form pertaining to Questions information are:

Category: This field will contain the Existing Category details.

Questions: This field contains the name of Question (details).

Option: This field contains the option need to be selected by investor based on category.

Sequence: This field contains the sequence of the question based on the Category

Score : This filed contains the score for the option .

c. Investor Category Master

Investor is basically grouped under various categories like Risk Averse, Conservative, Moderately and Aggressive etc.This investor is grouped based on the scores he got by answering the questions given to him. Each Investor Category is defined between a score range.The field is captured in this form pertaining to Investor Category are:

Investor Category: This field contains the name of Investor category(details).

Score Range Begin: It defines the range of the beginning score for the investor category.

Score Range End: It defines the range of the Ending score for the investor category.

d. Recommended Asset Risk Profile Master

It is used to create the Recommended Asset Risk Profile based on the Investor category and can update the existing Risk Profile Master.The field is captured in this form pertaining to Recommended Asset Risk Profile Master are:Investor Category: This field contains the name of the Existing Investor category (details).

High risk/High Return: This field defines the allocation return percentage based on the investor category

Medium Risk/ Medium return: This field defines the allocation return percentage based on the investor category

Low Risk/Low return: This field defines the allocation return percentage based on the investor category.

e. Recommended Asset Class Master

- Inflation Rate Master

It contains Inflation Rate Percentage details (%) based on the Applicable date

The fields are captured pertaining to:

Applicable date: This field contains the date values which can be applicable for inflation master till it is mentioned.

Rate (%): This field defines the percentage range.

- Disclaimer Master

It defines the disclaimer.

- Asset Wrap Master

Combination of Various Instrument, Risk Class and schemes creates an asset wrap. This gets compared with the investor financial assets corresponding to Investor Risk Profile.

- Reports

a. Download Tracking Report

It defines how many reports have been downloaded of the investor. Keeping track of the Investor report downloaded.

- Selection of Investor

- Risk Profile

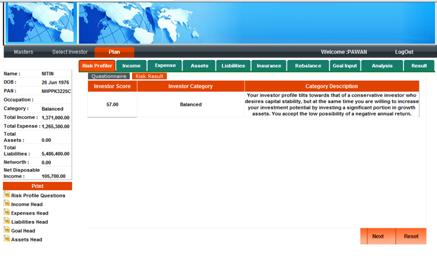

a. Questionnaire

It illustrates the Predefined questions and answering options will be given to the user which the user needs to select an answer for each question. Each question will carry a score a defined in the masters.

Finally based on the scores got by the user the investor category will be determined and based on the category his Risk allocation will be displayed. The allocation spread given by the investor will be compared with the predefined allocation in the system for the given category for all asset classes and asset categories and the risk behavior will be determined.

b. Risk Result

It illustrates finally based on the Investor Category a report can be generated where based the investor’s current percentage of asset allocation and the recommended allocation (Model Portfolio allocation as per the investor category) is displayed to the user.User can also modify the percentage of asset allocation in each asset class/category./scheme.

- Income

It illustrates Investor Income details along with periodicity, Expected percentage changes based on the factors like Life Expectancy, Expected Retirement Age, and Amount. The fields are captured in this pertaining to Income form :

- Salary

- Rental Income

- Business Income

- Allowances

- Other Income

- Expense

It is useful to enter the expense details and to display the total Expense and net disposable income. The fields are captured in this pertaining to Goal Input form

- House Hold

- Traveling

- Education

- Medical

- House Rent

- Entertainment

- Credit Cards

- Asset

It enables to create the investor asset details and display the total assets amount. The fields are captured in this pertaining to Goal Input form

- Financial Asset Equities

- Financial Asset Mutual Funds

- Financial Asset Fixed income instruments

- Financial Assets – Insurance

- Financial Asset – Cash

- Non-Financial Assets

- Liabilities

It facilitates to enter the liabilities details also to display the net worth amount based on Type of Loan, Loan Tenure in which year Loan started. The fields are captured in this pertaining to Goal Input form

- Personal Loan

- Vehicle Loan

- Home Loan

- Credit card dues

- Business Loan

- Education Loan

- Other Loans

- Rebalance

a. Available Investment

It defines collection of Assets amount and different category.

b. Portfolio Rebalance

Portfolio is rebalanced on the basis of asset wrap based of Risk Profile of the investor and the portfolio is rebalanced based on available investment and expert financial report.

- Goal Input

It illustrates the Goal Input details and current cost of goal, no of years to achieve that goal also expected changes in percentage.

- The fields are captured in this pertaining to Goal Input form

- Retirement Planning

- New House

- New Car

- Daughter marriage

- Analysis

a. Dash Board

It is the heart of the project. It explain overall of the project means the goal of the investors is how much met and how much is required on graph basis. Calculating the overall financial status of the investor. Taking care of net saving, Assets and portfolio gives the overall knowledge of the chart of Goal status.

b. Goal Allocation

Goals can map with different assets. Such as Purchase of New Car can be mapped with Other Assets.

- Result

a. Projection Sheet

b. Summarize Financial Plan.

c. Complete Financial Plan.

d. Asset Recommendation.

Hello

I require your source code for Financial Planning and Analysis Project.

How can I get it? Please suggest..