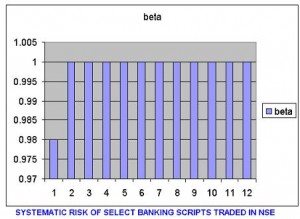

Systematic Risk of Select Banking Scripts Traded in NSE MBA Final Year Project Objectives:

• To measure the comparative beta analysis of selected Indian banks.

• To evaluate the correlation between nifty returns and ICICI bank returns.

• To evaluate the correlation between Nifty returns and HDFC returns.

• To evaluate the correlation between Nifty and Andhra bank returns.

• To evaluate the correlation between Nifty and Vijay bank returns.

Limitations

1. The data collected is only from secondary source.

2. The data which is collected for doing this report has been collected from Internet Websites where there can be some hitches.

3. The Time period taken for doing the data analysis has been from from NSE (Nifty) 2006-07.

1. b Data Collection Methods

1. b Data Collection Methods

For the purpose of the study was collected through secondary source of data collection method. Major source of data are published stock prices of HDFC, ICICI Bank AND NIFTY.

1.c Time Period:

I collected weekly average prices of HDFC, ICICI BANK AND NIFTY for the period of APR 2006-MAR 2007.

Conclusion:

1. During the period 2006-07, there was high correlation between Nifty and ICICI, HDFC, Andhra Bank, Vijaya Bank

2. During this period, all the selected banks Retunes and NSE Nifty returns are moving in same track.

3. During this period, there is more volatility in Returns of Stock and Market.

4. During the 6th month, the Returns of ICICI (y) is 2.01 where as the Returns of Nifty (x) is 5.79, there is sudden surge.

5. During the 3rd month, the Returns of Vijaya Bank (y) is 74.08 where as Nifty (x) is 21.73 only, there was sudden fall in market.

Download Systematic Risk of Select Banking Scripts Traded in NSE MBA Project Case Study.

hi i am doing mba in finance and seaching for project in indiabulls housing finance limited.. cn u please help me in that…………..

I also

Need ready made MBA Dissertation?????? Just edit 2-3 pagers and print.

Contact:

faisal.lib79@yahoo.com