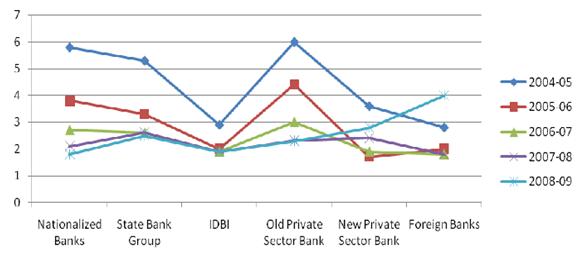

Non-performing assets as percentage of advances showed a declining trend for nationalized banks, state bank group, IDBI and old private sector banks.

There was overall decline in the NPA. The NPA was more for non-priority sector during the year 2008-09. The NPA for public sector loans were least. The analysis category wise showed that NPA were more for new private sector banks and foreign banks. The NPA as percentage of total assets for nationalized banks there was a slight increase in NPA. The impact analysis proved that NPA had negative impact on net profit where as for NPA and total advances there was positive impact (Dickin Goyal, 2010)

Macro perspective behind NPA:

A lot of practical problems have been found in Indian banks, especially in public sector banks. For example, the government of India had give a massive wavier of Rs 15,000 Crs under the prime minister ship of Mr. V.P.Singh, for rural debt during 1989-90. This was not a unique incident in India and left a negative impression on the payer of the loan.

Poverty evaluation programs like IRDP, RREP, SUME, SEPUP, JRY, PMRY, etc, failed on various grounds in meeting their objectives. The huge amount of loan granted under these schemes were totally unrecoverable by banks due to political manipulations, misuse of funds and non-reliability of targets.

What are the causes of non-performing loans in the banks?

a) There may be different causes for non-performing loans which vary from bank to bank. Some of them are improper verification of the customer’s background, recklessness in the process of giving loans, lack of recovery steps taken by the Management etc.

b) More likely corruption role is not only encountering from outside it is involved inside as well before we misguide entire situations. Most reasons are dishonest proceedings, pending files, careless work, higher level demands, political plays from inside and outside, negatively impacting the organizational environment.

c) One of the most serious impact however is on commercial banks

d) Poor corporate governance, poor general public, lack of transparency.

- What are the specific steps that should be taken by the bank mangers?

a) Bank managers should verify the customer’s background perfectly and provide the loans for only genuine customers. They should take some measures in order to recover the loans.

b) Despite sincere has to be taken to help them improve work performance. It is not working and they are increasingly proving to be NPA it may be time to fire such employee(s) but the organization must follow well defined legal and ethical steps in terminating their services.

c) Avoiding wrong economic decisions and providing new financial services.

d) Banks can exchange information on the bad borrowers which will be more convenient to track those borrowers.

- Can the value of non-performing assets be increased when compared to

Worldwide financial market?

a) Yes, if the bank management does not follow particular methods or procedures then the value of non-performing assets will increase.

b) Yes, but there are possibilities for having non-performing assets it might be world crisis, unemployment, economic downturns or unstable conditions.

c) Yes, it might be possible in different ways.

d) Not sure, but compare to current inflation rate yes.

- How to overcome the loan recovery problem?

a) The bank management should maintain an efficient recovery team so that the customer’s details would be updated regularly.

b) Banks must estimate loss given default that aims to reflect economic downturn conditions and perform adequate legal frame works to ensure that loan recovery is legal.

c) Costs enough to overcome the effects on lender revenues of suppressed interest rates, providing loan recovery agents.

d) Analyzing on country side financial status to invest money on booming sector.

- How to attract the depositors for the decrease in the value of non-performing

assets?

a) Bank management should attract the depositors by providing them some benefits in the interest rates etc.

b) Performing the competitive interest rates and focusing on customer needs and requirements

c) By giving awareness of long-term goals rather than shot-term goals

d) Offering promotions to absorb depositors mostly on agricultural sector in a country like India.