The project titled “leveraged buyout in India” gives us the brief idea regarding leveraged buyout’s (mergers & acquisitions) and its present scenario in Indian market. The various things that can be known through the study of this report are the history of leveraged buyout, buyout effects, challenges associated with it, governmental policies, and brief history about Indian banking sector & private-equity firms.

The project provides us basic knowledge regarding Fundamental by studying financial structure and characteristics of companies. Overall, it provides a greater exposure to international finance by studying the financial aspects & terms associated with the study.

OBJECTIVE OF THE STUDY:

OBJECTIVE OF THE STUDY:

1. To know standards required for a company to go for Leveraged buyout deal

2. To study post leveraged buyout deal in metal industry (TATA-CORUS)

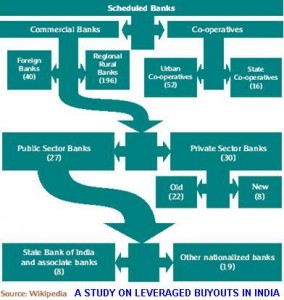

3. To study banking & private equity firms

SCOPE:

The study is limited only to few Indian firms

It covers only a brief snap shot about Indian banking industry and private equity firms with respect to debt financing in various buyouts

The study is limited to the availability of information, and it does not covers international accounting policies, procedures or any legal aspects, only limited information which deals with the project has been studied

The thirst for LBOs has led Indian companies to take loans totaling Rs 60,000 crore.

Cash-rich western bankers have been happy to make the loans. But repaying them will be tough.

Many LBOs involve commodity players. Downturns in commodity prices could sink these companies

Download A Study on Leveraged Buyouts in India MBA Project