ABSTRACT:

Correlating BSE Sensex with NASDAQ stock exchange.

This Correlating Indian Stock Indices (BSE) With American Stock Indices (Nasdaq) MBA Project study tries to analyze the relation between BSE sensex with NASDAQ.

This Correlating Indian Stock Indices (BSE) With American Stock Indices (Nasdaq) MBA Project study tries to analyze the relation between BSE sensex with NASDAQ.

When BSE sensex increases to new highs questions arises that weather there is an increase in other world stock market or not, I tried to find out the correlation between BSE sensex with NASDAQ

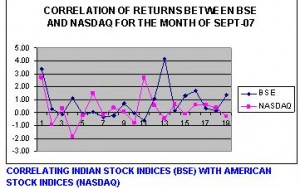

For this purpose I have collected daily 1 year closings from 1st JAN 2007 to 31st DEC 2007 of BSE and AMERICAN stock markets.

FINDINGS OF THE STUDY:

The study suggested that there is an overall positive as well as negative correlation between BSE sensex and NASDAQ.

The study supports that mergers of top Indian companies will have its effect on Indian as well as foreign stock markets also.

OBJECTIVE OF THE STUDY:

• To Analyze The Performance Of Bse Sensex.

• To Analyze The Performance Of Nasdaq.

• To Know The Risk And Return Of The Bse &Nasdaq.

• To Correlate The Performance Of Bse Sensex With Nasdaq With The Help Of Returns.

• To Identify The Factors Influencing The Indices.

CONCLUSION:

Here correlation means relationship between two or more variables. In this study we have taken two variables BSE SENSEX and NASDAQ.

In the month of April the correlation between BSE SENSEX and NASDAQ is 0.49.so there exists slight positive relationship and all data points are form as non linear structure and tilts upwards towards right.

Remaining all the months there exists low correlation, and in the months of July and May there exists negative correlation ie -0.17 and -0.69, so there exists strong negative relationship and all data points tilts downward towards right.

There is an overall positive as well as negative correlation of returns between the BSE sensex and NASDAQ stock exchange, because out of (12) month data collected (10) months have positive correlation and (2) months have negative correlation on returns. It shows that when BSE is increasing NASDAQ is decreasing and vice-versa because financial institutions are the main investors in BSE sensex

If we see the closing of both BSE and NASDAQ it’s as follows. BSE started with a closing of 13940.14and NASDAQ started with a closing of 2422.41

By seeing the closing of both the stock markets we can say that increase and movement of funds is more in BSE when compared to NASDAQ.

Download Correlating Indian Stock Indices (BSE) With American Stock Indices (Nasdaq) MBA Finance Final Year Project.