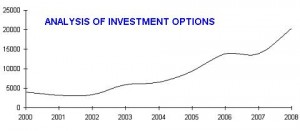

The “Analysis of Investment Options MBA Project” gives the brief idea regarding the various investment options that are prevailing in the financial markets in India. With lots of investment options like banks, Fixed Deposits, Government bonds, stock market, real estate, gold and mutual funds the common investor ends up more confused than ever. Each and every investment option has its own merits and demerits. This project I have discussed about few investment options available.

Any investor before investing should take into consideration the safety, liquidity, returns, entry/exit barriers and tax efficiency parameters. We need to evaluate each investment option on the above-mentioned basis and then invest money. Today investor faces too much confusion in analyzing the various investment options available and then selecting the best suitable one. In the present project, investment options are compared on the basis of returns as well as on the parameters like safety, liquidity, term holding etc. thus assisting the investor as a guide for investment purpose.

Any investor before investing should take into consideration the safety, liquidity, returns, entry/exit barriers and tax efficiency parameters. We need to evaluate each investment option on the above-mentioned basis and then invest money. Today investor faces too much confusion in analyzing the various investment options available and then selecting the best suitable one. In the present project, investment options are compared on the basis of returns as well as on the parameters like safety, liquidity, term holding etc. thus assisting the investor as a guide for investment purpose.

OBJECTIVE OF THE STUDY

The primary objective of the project is to make an analysis of various investment decision. The aim is to compare the returns given by various investment decision. To cater the different needs of investor, these options are also compared on the basis of various parameters like safety, liquidity, risk, entry/exit barriers, etc.

The project work was undertaken in order to have a reasonable understanding about the investment industry. The project work includes knowing about the investment DECISIONS like equity, bond, real estate, gold and mutual fund. All investment DECISIONS are discussed with their types, workings and returns.

METHODOLOGY

Equities, Bonds, Real Estate, Gold, Mutual Funds and Life Insurance were identified as major types of investment decision.

The primary data for the project regarding investment and various investment DECISIONS were collected through.

The secondary date for the project regarding investment and various investment DECISIONS were collected from websites, textbooks and magazines.

Then the averages of returns over a period of 5 years are considered for the purpose of comparison of investment options. Then, critical analysis is made on certain parameters like returns, safety, liquidity, etc. Giving weight age to the different type of needs of the investors and then multiplying the same with the values assigned does this.

LIMITATIONS OF THE STUDY

– The study was limited to only six investment options.

– Most of the information collected is secondary data.

– The data is compared and analyzed on the basis of performance of the investment options over the past five years.

– While considering the returns from mutual funds only top performing schemes were analyzed.

– It was very difficult to obtain the date regarding the returns yielded by real estate and hence averages were taken.

Download Analysis of Investment Options MBA Project

I want this project report for final yearpgdba/MBA in finance from SCDL PUNE. LEY ME KNOW WHETHER IT WILL BE ACCEPTED BT THEM. WHAT IS COST I HAVE TO PAY & WHETHER IS IS READLY AVAILABLE SAY IN WEEK TIME.

.

thank you so much

I want mba operation projects.

Thanks as by this project I can also be able to gather some knowledge for the project title I have to make.

Can i get the questionnaire for the project of an analysis of investment options available in the market of India.

can i get quesstionnaire