The field of financial services in India has entered another stage of development with a shift in its outlook to integrate with the global markets. Investors confidence, Quality services, Customer expectation and Satisfaction, Quick response, Technology integration are the words today.

With liberalization and deregulation, the Indian markets have come out of the Government curtains. The capital market has made tremendous progress since then aspect.

Proper market infrastructure, regulatory and legal frameworks are essential for emerging capital markets to function effectively in a growing world of financial integration. With the vast investing population in India characterized by illiteracy and poorly developed and automated stock exchanges which do not provide enough liquidity and desired level of transparency in operation Government of India in 1996 enacted the Depositories Act, 1996 to kick start depository services in India in a planned and systematic manner. Securities and Exchange Board of India (SEBI) provided the support to the Government’s endeavor.

A Depository is an organization where the securities of shareholders are held in an electronic form at the request of shareholder. It is an electronic solution to problems of dealing in physical form and conducting transactions in capital market in a more efficient and effective manner.

A Depository is an organization where the securities of shareholders are held in an electronic form at the request of shareholder. It is an electronic solution to problems of dealing in physical form and conducting transactions in capital market in a more efficient and effective manner.

The Depository holds securities in an account , transfer securities between account holders, facilitates safekeeping of securities and facilitates transfer of ownership without transfer of securities. Depository system is long prevalent in the advanced countries and has been playing a significant role in the stock market around the world. The system is time tested and reliable.

NEED FOR THE STUDY

Need for a Depository in India:

Over the last decade, the Indian capital market has been growing by leaps and bounds. India has the largest number of listed companies in the world today. Paradoxically the problems associated with the settlements of trades are also on the rise. As a result of this, investors have to face a lot of inconvenience in effecting registration of securities in their favour and to ensure that they receive their rightful share of dividend, bonus, rights and other benefits.

The old system of stock trading and settlement is featured by increased market and operational inefficiencies. This section of the market comprises the Secondary market which is popularly called as the “Stock Market” comprising of 23 Stock Exchanges and is the organized market regulated by the SEBI for purchase and sale of securities through intermediaries called stock brokers and sub-brokers.

The Government of India promulgated the Depositories Ordinance in September 1995, thus paving the way for setting up of Depositories in the country. National Securities Depository Limited (NSDL) was inaugurated as the first depository in India on 8th November 1996. It is responsible for holding and handling of securities in electronic form eliminating problems that are normally associated with physical certificates like mutilation due to careless handling, loss in transit, problems of bad deliveries etc.

OBJECTIVES OF THE STUDY

The basic objectives of the A study on Depository Participant Service Process at Fortune Financial Services (India) Limited are:

– To know and understand the need and importance of scrip less trading in the capital market.

– To understand the concept of Depository system in India.

– To study the role of a depository participant as a business partner to Depository with special emphasis on Fortune Financial Services (India) Limited.

– To evaluate the working of a Depository Participant in accordance with Central Depository Services (India) Limited (CDSL) guidelines and determine the ways and means of improving its efficiency.

SCOPE OF THE STUDY

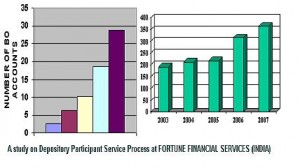

The present study concentrates on Depository Participant Service Process. The study is made in real working environment and emphasis is given on various intricacies under the Depository Participant operational work at Fortune Financial Services (India) Limited.

Download A study on Depository Participant Service Process at FORTUNE FINANCIAL SERVICES (INDIA) LIMITED

Nice case study

thanks for share