Characteristics of Portfolio Management:The project report covers portfolio management of a HNI. These individuals have surplus money, which can be invested into various investment avenues. For example land, stock market, bank deposits, government securities etc., Each Investment avenue open to HNI’s has been evaluated on the basis of risk and return. No individual wants his/her savings to lie ideal and be eaten by inflation.These individuals are constantly looking for opportunities to invest their surplus money and get good returns. Professional investor advisors provide this service. They personally look into the risk appetite of the investor and design the best suited portfolio from him./her. For this purpose a case study was conducted on the ING Vysya’s 10 HNI’s to find out how they perceive different investment avenues. The bank faces low conversion rate of investment advisory services. Therefore after the study and analysis recommendations have been made to the RM’s on how to improve the service.

This has been done in the following sequence. First the HNI’s and their investment avenues were analyzed. Then the risk and return of each investment avenue was conducted. After which a sample of 10 HNI customers were visited. Analysis of these HNI’s showed some patterns in which these customers invest and how they perceive each investment instrument. On the basis of such data recommendations were made to the relationship managers.

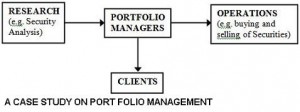

Download A Case Study on Port Folio Management MBA Project.